Auto depreciation calculator for taxes

But for the next year your wdv will be considered as reduced by the percentage of depreciation prescribed. Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade.

Pin Em Cost Of Goods

We will even custom tailor the results based upon just a few of.

. The basis is multiplied by our business-use percentage to determine the depreciable basis of the vehicle for tax purposes. Using the values from the example above if the. There is a dollar-for-dollar phase out for.

It takes the straight line declining balance or sum of the year digits method. The calculator makes this calculation of course Asset Being Depreciated -. 3rd Tax Year 10800 Each Succeeding Year 6460 Table 2 provides depreciation deduction limits for passenger automobiles placed in service by the taxpayer during calendar.

The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. Years 4 and 5 1152. Prime Cost Depreciation Method The Prime Cost method allocates the costs evenly over the years of ownership.

Business vehicle depreciation refers to the amount of wear and tear a company vehicle SUV or truck experiences in its lifespan. Depreciation can be claimed at lower rate as per income tax act. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

Learn How Much A New Car Depreciates How to Calculate Depreciation. If you are using the double declining. By entering a few details such as price vehicle age and usage and time of your ownership we.

Work-related car expenses calculator. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation.

Cargo vans semi-trucks or vehicles that weigh more than 6000 pounds these can generally be. Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

Cost x Days held 365 x 100 Effective. The tool includes updates to reflect tax depreciation. The calculator also estimates the first year and the total vehicle.

According to the general rule you calculate depreciation over a six-year span as follows. If youre in the market for a brand new car maybe youre using that tax refund to take care of the down. For eg if an asset.

Similar to personal cars your business vehicle declines in. The MACRS Depreciation Calculator uses the following basic formula. Alternatively if you use the actual cost method you may take deductions for.

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. It can be used for the 201314 to. This limit is reduced by the amount by which the cost of.

If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. Section 179 deduction dollar limits. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

The following calculator is for depreciation calculation in accounting. Year 1 20 of the cost. Use this depreciation calculator to forecast the value loss for a new or used car.

This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided. However if you elect to take bonus depreciation you can deduct up to 18000 in year 1. The IRS has announced the 2022 inflation-adjusted Code 280F luxury automobile limits on certain deductions that may be taken by taxpayers using passenger.

In the example shown above the.

5 Tips For Buying A Car The Smart Way Car Buying Car Buy Used Cars

Airbnb Property Analyzer Income Property Investment Etsy In 2022 Investing Income Property Investment Property

Airbnb Property Analyzer Income Property Investment Etsy In 2022 Investing Income Property Investment Property

Airbnb Property Analyzer Income Property Investment Etsy In 2022 Investing Income Property Investment Property

Accountantteams I Will Do Bookkeeping In Quickbooks Online And Xero Accounting For 10 On Fiverr Com Bookkeeping Services Bookkeeping Credit Score

So You Like That Leased Car So Much That You Want To Buy It Now Here S How Car Loans Car Car Title

Pin On Shakti Nissan General News Board

Projected Profit And Loss Account In Excel Format Profit And Loss Statement Statement Template Spreadsheet Template

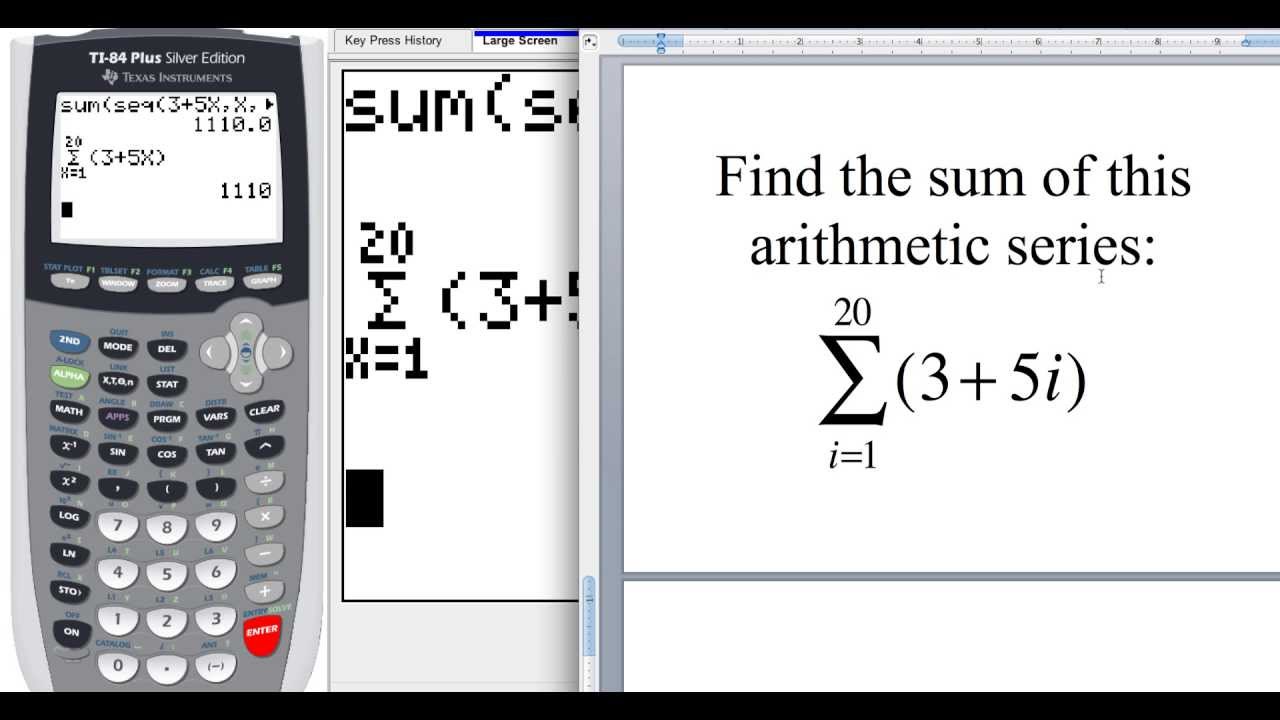

12 2 How To Find The Sum Of An Arithmetic Sequence On The Ti 84 Precalculus Graphing Calculators Arithmetic

Airbnb Property Analyzer Income Property Investment Etsy In 2022 Investing Income Property Investment Property

Five Star Luxury Limo Service Inc Limousine Black Car Service

Mileage Log Template For Taxes Luxury Vehicle Mileage Log James Orr Real Estate Services Door Hanger Template Templates Custom Door Hangers

Cash Flow Projection Template Flow Chart Template Cash Flow Cash Flow Statement

Pros And Cons Paying Your Mortgage Off Early Part 3 Hold Up There Are A Credit Card Che Mortgage Payment Calculator Mortgage Payment Credit Cards Debt

Afinoz Mortgage Loans Business Loans Best Mortgage Lenders

Real Estate Lead Tracking Spreadsheet

Projected Income Statement Template New Projected In E Statement Template Free Amazing Design Statement Template Mission Statement Template Income Statement